Ideally, as an artist, I would move through these steps starting as a young artist at the beginning of my career and moving on from there, but you know what they say about planting a tree. The best time to do so was 20 years ago, the second best time is today.

Assess your finances. Fill out a net worth statement to make sure you know what your debts and your assets are.

The nice thing about this step is it is super tangible. You just set aside a few hours one night and list all your assets and all your debts.

The very first time you do this can have some hurdles. You may need to setup online accounts or request passwords you’ve forgotten. If you’re a younger artist and your parents had been saving anything for your future, this is a good time to ask them about it.

You can do this manually each month or you can automate your future tracking by signing up for an account at Mint or Personal Capital. They’re both free and after you put in the initial effort to link your accounts, you can check out your net worth all in one spot.

You need to know where you are to know where you’re going.

Make your debt pay down or nest egg build up plan.

This might be a super charged, double down on side jobs and other hustles for a year or two to eliminate a bunch of debt or build up an emergency fund or it might be a longer term plan stretched over 20 years that eventually still hits your goal without disrupting your life much.

I can’t emphasize enough how being debt free opens more doors to you in the arts, but if your debt amount is currently massive, you may need to figure out how to balance income that allows you to pay it off and following some version of your dreams at the same time.

If your debt is massive, working with a company like Debt.com can help you figure out the best ways to consolidate some of it and help you develop a personalized plan of attack.

If you have little or no debt (congrats!), it’s time to focus on building up that emergency fund. Personally, I really prioritized building my emergency fund until it hit $1,000. Then it was still a fairly high priority up to $5,000. Since then I just set an amount I aim to add each year and if I get the occasional windfall or extra high paying gig, I’ll try to go a little above and beyond my goal.

And what I mean by prioritizing versus adding it to my goals for each year is that after you’ve got your debt plan/emergency fund build up plan rolling, it’s time to move to stage three, even if you’re still working on stage two a bit.

Plan for retirement. Yes, it probably seems ages away but that’s perfect because the further away it is, the less you have to save each month for it to have an overall very powerful effect.

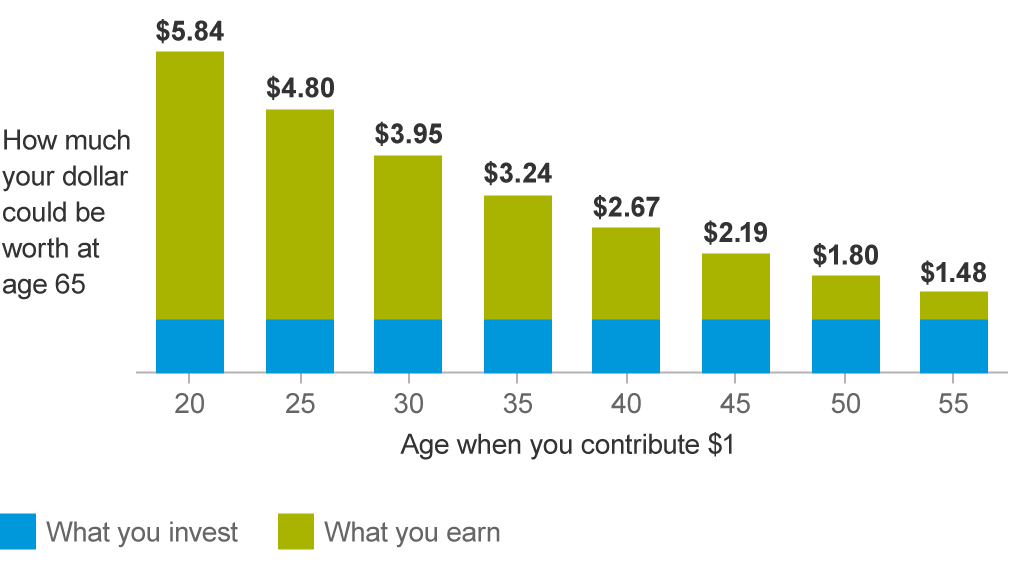

So I’m going to put this little graph below with the full disclosure that I kind of hate them, because what are the odds a 20 year old is reading this right now?

Pretty slim, so the rest of us probably feel that deep sigh of lost gains. But a 20 year old might be reading this and unaware of that. And for the rest of us, it just shows that whatever age you are, the sooner you can start, the better.

As many of us are self-employed, you’re likely on your own with your retirement plans. For the majority of folks, I’d consider starting with a Roth IRA, as long as you qualify. As a single person, you have to make less than $137,000 (as of 2019).

A nice thing about this account is that you can withdraw your contributions at any time and after 5 years, you can withdraw even the earnings for qualified expenses such as being disabled or buying your first home.

I don’t recommend doing that, because it will wreck the power of compound interest and mess up your retirement plans, but the fact that the option is there in the worst case situations, is nice.

An additional account that can very useful for both retirement planning and to tap in emergencies is a Health Savings Account. If you have a qualified health insurance plan, this account can act as both an investment vehicle and savings account. You can read more about the power of Health Savings Accounts in this post here.

At this point, you’ve got the beginnings of a solid bucket system, which is a really excellent financial plan for freelancers.

The buckets are different accounts you can raid for cash (mostly in emergencies).

My buckets look like this:

Checking Account –> Emergency Savings –> Car Savings –> Brokerage Account –> House Down Payment Account –> Health Savings Account –> IRA

If you’ve worked through the other stages, you should have a bucket system that looks something like this:

Checking Account –> Emergency Savings –> Health Savings Account and/or IRA

That’s a really comfortable place to be in compared to so many arts workers!

In stage four, you consider your other buckets. This is where you think about mid-term goals. Will you need a new car soon? Are you hoping to buy a house someday? Are you saving for your kids college costs? Do you have some spare cash and you want to open a brokerage account to invest in some stocks?

Some of these may be more pressing than others. You may decide if you already have a strong emergency fund base to prioritize sending some money to a house down payment account or your kids college fund savings because they are more pressing goals.

At step four, you lay out all your goals and decide how you’ll allocate your money towards them.

Some people can zip right through these stages and into a strong financial position through a combination of hard work, luck and privileges. Others may have more obstacles and take a much longer time to get from stage one to stage four.

A nice thing is that if you have to stay in one stage for a long time, there are probably others on the same path as you. One thing I’ve always loved about the personal finance community is that there’s pretty good odds someone out there is blogging from a similar background, with similar challenges, and similar goals.

I also like that there are blogs from people at all steps of this journey – from people deep in a hole starting out on day one to people who started in a hole and are now millionaires. Some of their advice seems useless to me, but some of it is really valuable.

I’m hopefully if we all keep plugging away, we’ll be able to improve our situations with enough time and perseverance.

Support the Arts Side Hustles #BeAnArtsHero

Melissa Bondar is a touring stage manager and personal finance enthusiast who blogs at brokeGIRLrich. She has been stage managing since 2004 and some of her favorite jobs include working with Ringling Brothers and Barnum & Bailey Circus, Sleep No More, and Big Apple Circus. She also did a lengthy stint with Holland America Line onboard their ships at the beginning of her career. Along the way, she realized she was pretty concerned about whether or not she’d ever be able to retire and started learning more about personal finance. The more she learned, the more she realized we really needed to improve our financial literacy in the arts, so she’s been blogging about it ever since.

Read Full Profile© 2021 TheatreArtLife. All rights reserved.

Thank you so much for reading, but you have now reached your free article limit for this month.

Our contributors are currently writing more articles for you to enjoy.

To keep reading, all you have to do is become a subscriber and then you can read unlimited articles anytime.

Your investment will help us continue to ignite connections across the globe in live entertainment and build this community for industry professionals.